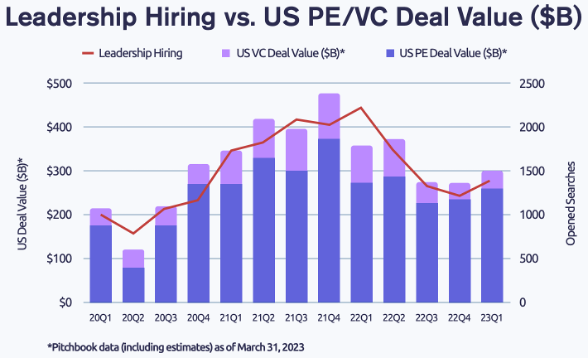

In their latest Executive Search Report, Thrive noted that following a precipitous drop in executive hiring to close out 2022, the market seems to have found stability. Opened searches increased nearly 12.5% in Q1, the largest quarterly uptick Thrive said it has seen in its dataset in almost two years. Closed searches also increased, similarly posting its largest quarterly rise since Q4 2021.

Still, demand for talent has been uneven for at least a year, according to an analysis by Hunt Scanlon Media, and it has been notably cooling in Q2. Search firms are considering all sorts of strategic steps to keep growth going from entering new niche verticals and expanding into adjacencies that align with their offerings, to acquiring rivals, and establishing global footprints.

The PE, VC, and tech sectors have played an outsized role in the expansion of the search industry for much of the last decade. That makes this all the more interesting to note from Thrive: “While the PE market looks to be a bright spot [for recruiters], it appears to be creating that shine in a more concentrated fashion.”

On the VC side market conditions have slowed to a crawl. In March, CB Insights reported that the median time between funding rounds lengthened by at least five months for each round since the beginning of 2021. Thrive’s analysis reveals that the slowdown in VC led to falling search volume. This news comes with a silver lining however, as it was the least precipitous quarterly drop since the market reached its peak in late 2021 and early 2022. It appears the downward momentum in VC search is beginning to slow.

As for tech, if last year was the story of a potential tech-specific recession, Q1 seems to be asking everyone to wait on fully committing to that narrative, according to Thrive. The tech-heavy Nasdaq finished up 17% in Q1, giving the index its best quarter in more than two years. Cody Crook, Managing Director of Hunt Scanlon Ventures, offers up his take on what it all means for search firm founders, recruiters, and the PE sponsors that invest in them.

Cody, how can search firms navigate the shifting landscape of PE search?

This isn’t an easy environment to navigate. The reality is that search firms are set up to service a PE environment with higher deal volume. However, all indications are that deal volume will recover in the near term. PE remains a booming industry, permeating every sector, with record levels of dry powder stashed away. As economic uncertainty has persisted, we’ve seen PE firms take a much more cautious approach, only deploying their dry powder in deals they have a high level of confidence in. Record breaking dry powder storage combined with uncertainty has led to this environment that we now find ourselves in. But in our view, it is temporary. The sheer ability of private equity firms to deploy capital, albeit strategically, speaks to the overall health of PE as an industry. As uncertainty fades this will result in a return to higher deal volume, and a fruitful environment for executive search.

“As uncertainty fades this will result in a return to higher deal volume, and a fruitful environment for executive search.”

What’s the knock-on effect for search firms?

There is a distinct market shift underway in executive recruiting. After years of high growth and even a quick correction around Covid-19, recruiters are seeing any number of sectors softening this year. It is not the mudslide we saw in the Great Recession, far from it. But it is something the industry hasn’t really seen in at least a decade and so it is giving search firm founders pause about where they can best deploy their own capital and, more importantly, where they should look for growth.

And venture capital? What are you seeing there?

VC has really taken it on the chin. But VC has long been viewed as a growth engine for the country and so, yes, it is soft right now. But it will bounce back big. No one should write off the horsepower of VC-backed businesses and high growth enterprises and their overall value to the American economy. Same with tech. I think we are all reading too many headlines about tech layoffs, when in fact the sector is already looking ahead to new technologies, like AI, and all the growth potential that will come with that. It is so important that we step outside of the news bubble that the media creates and look to the distance for opportunity.

Where do you see executive search headed this year as we round into the second half of 2023?

I’m bullish. Despite similar market turbulence last year, executive recruiters pulled out another remarkably strong performance. The industry grew 11 percent in the U.S. and nearly 10 percent globally. The Hunt Scanlon Top 50 search firms generated more than $6.5 billion in fees last year. That’s a record. And the Hunt Scanlon Big 5 global firms outpaced themselves again, reporting nearly $7 billion in total fees. This is a healthy and resilient sector by any stretch. Even as headwinds batter the economy, the recruiting industry continues to grow. I have no reason to believe that is going to change.

“This is a healthy and resilient sector by any stretch. Even as headwinds batter the economy, the recruiting industry continues to grow. I have no reason to believe that is going to change.”

Why is the recruiting sector so resilient?

The industry remains incredibly dynamic. We see search firms taking all sorts of strategic steps to maintain growth. Many are raising capital to do it or joining arms with growth partners. Search firms are developing new product offerings, entering new sectors, pruning low performing talent, and top grading where they can, acquiring rivals, and expanding into adjacencies that align with their offerings. Even as the environment shifts, the growth story continues.

What part of the Thrive report makes you optimistic?

I really appreciated the data outlining how closely trends in leadership hiring track to PE/VC deal value. Q1 saw the beginning of an upswing in this metric. There are many reasons to be optimistic about the state of private capital investment, particularly on the PE side. This data makes it all the more apparent why the optimistic reasoning that applies to PE essentially applies to executive search as well.

Article By

Cody Crook

Cody Crook is managing director and head of investment strategy at Hunt Scanlon Ventures - an M&A advisory firm that specializes in the human capital space. Cody is responsible for co-managing the firm's investment portfolio, which includes executive search, talent acquisition, private equity, and investment firms. Leading the investment team, he spearheads all fund transactions and maintains portfolio developments. He is also responsible for sourcing, managing and monitoring investments and working with external portfolio managers, analysts and investors on active and prospective transactions. Connect with Cody.